Elon Musk Attempts Hostile Takeover of Twitter

In an Attempt to Privatize the Platform, Elon Musk Offers $43 Billion Bid

Just as everyone thought the fun was over and that Elon would be joining Twitter’s board of directors, he shocked everyone again by filing yesterday with the SEC, this time attempting to buyout the entirety of Twitter.

“100% of Twitter for $54.20 per share in cash, a 54% premium over the day before I began investing in Twitter and a 38% premium over the day before my investment was publicly announced” he stated in the SEC Filing

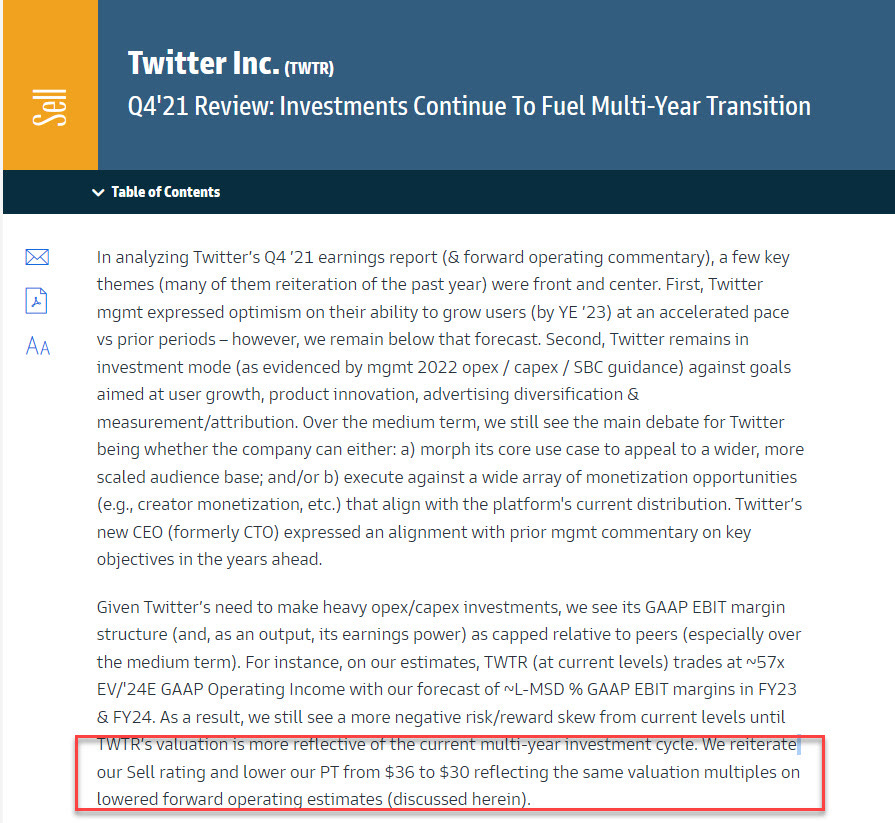

Now in response Twitter is holding an emergency all hands meeting, with many speculating the board may deny the offer considering they hired Goldman to “advise” that his offer is too low. Only problem is when we look at Goldman’s own review of Twitter even they admit that the future return on Twitter looks dim.

Elon has also hinted at a potential plan b if his offer is refused.

Stating in his filing,

“If the deal doesn’t work, given that I don’t have confidence in management nor do I believe I can drive the necessary change in the public market, I would need to reconsider my position as a shareholder”

His plan b is suspected to possibly involve tempting the shareholders with the prospect of a gain, in hopes that they’ll side with him and agree to privatize the company.

Also seeing how his $54.20 offer is currently hovering just over $45. That’s a substantial gain and it SHOULD be enough to temp shareholders, yet…

Alwaleed Talal, one of the crown princes of Saudi Arabia and the head chairman for Kingdom holding company, one of the most influential investment firms in the world. Has made a public rejection of Musk’s offer, to which was responded to in typical fashion.

The current future of Twitter seems to be falling more and more into Elon’s hands. If Twitter turns down his proposal and he leaves with his over 9% share, the stock price will take a huge hit. Something a company looking to make a profit would do best to avoid and would be in the shareholders best interest to avoid.

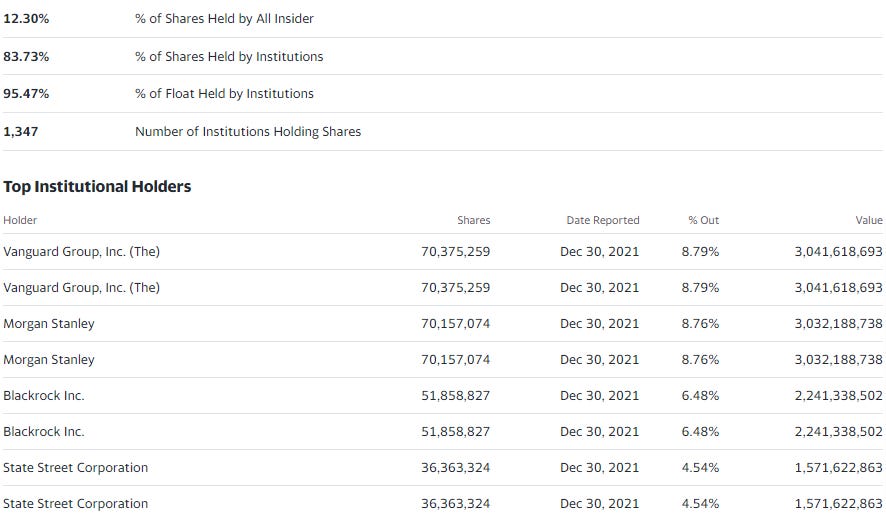

Instead the current board of Twitter along with its institutional shareholders seem to be more interested in getting across an ideological narrative instead of actually doing what’s best for the site. Which after a quick look at the top 4 institutional investors we see both Vanguard and Blackrock, who together are coordinating to own most of the worlds public resources. Relying on the consequential power to influence international policy decisions, which often include intense censorship and narrative control.

My personal prediction is that one way or another Elon Musk will be in control of Twitter though the outcome of that is still to be decided. Nonetheless it’s clear the power structure is uncomfortable with that reality.